Crm software for financial services – The financial services industry is a complex landscape demanding robust systems for managing client relationships. Customer Relationship Management (CRM) software has become indispensable for financial institutions of all sizes, from small wealth management firms to large multinational banks. This comprehensive guide explores the vital role of CRM in financial services, detailing its benefits, features, selection criteria, and addressing frequently asked questions.

Understanding the Needs of Financial Services CRM

Financial services CRM differs significantly from CRM solutions used in other sectors. The industry’s stringent regulatory environment, high-value transactions, and the need for personalized, secure client interactions necessitate specialized features. A robust financial services CRM must prioritize data security, compliance with regulations like GDPR and CCPA, and the ability to handle complex financial data efficiently. Key considerations include:

Data Security and Compliance

Protecting sensitive client data is paramount. Financial services CRM must adhere to strict security protocols, including data encryption, access controls, and audit trails. Compliance with industry regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, is crucial. Features like multi-factor authentication and role-based access control are essential.

Source: switchonbusiness.com

Client Relationship Management

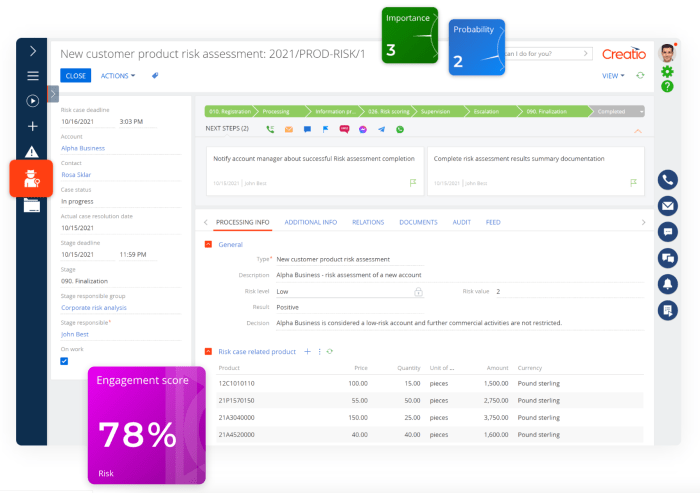

Effective client relationship management is at the heart of financial services. A CRM system should provide a 360-degree view of each client, including their financial history, investment portfolio, communication preferences, and risk tolerance. This holistic view allows advisors to personalize their services and build stronger client relationships.

Workflow Automation and Efficiency

Automating repetitive tasks, such as client onboarding, account updates, and reporting, is vital for increasing efficiency and reducing operational costs. A good financial services CRM streamlines workflows, allowing advisors to focus on high-value activities like client interaction and strategic planning. This includes features like automated email marketing campaigns and task management tools.

Reporting and Analytics, Crm software for financial services

Data-driven decision-making is crucial in financial services. A robust CRM system provides detailed reporting and analytics capabilities, allowing firms to track key performance indicators (KPIs), identify trends, and optimize their strategies. This includes customizable dashboards and reports on client acquisition, retention, and profitability.

Integration with Other Systems

Seamless integration with other systems, such as accounting software, portfolio management systems, and compliance platforms, is essential for a holistic view of the client and business operations. This avoids data silos and ensures consistent information across all departments.

Key Features of Financial Services CRM Software

Several core features differentiate a successful financial services CRM from a generic one:

- Client Portfolio Management: Track client assets, investments, and transactions in a centralized location.

- Contact Management: Maintain detailed contact information, communication history, and notes for each client.

- Sales and Lead Management: Manage leads, track sales progress, and analyze sales performance.

- Compliance and Regulatory Reporting: Ensure compliance with KYC/AML regulations and generate required reports.

- Document Management: Securely store and manage client documents, such as contracts and financial statements.

- Communication Tools: Facilitate seamless communication with clients through email, phone, and other channels.

- Workflow Automation: Automate repetitive tasks to improve efficiency and reduce errors.

- Reporting and Analytics: Generate customized reports and dashboards to track KPIs and analyze performance.

- Integration Capabilities: Integrate with other financial systems, such as accounting and portfolio management software.

- Security Features: Robust security measures to protect sensitive client data.

Choosing the Right CRM for Your Financial Institution

Selecting the right CRM involves careful consideration of your specific needs and budget. Factors to consider include:

Source: aimultiple.com

- Scalability: Choose a CRM that can grow with your business.

- Customization: Ensure the CRM can be customized to meet your specific requirements.

- Integration: Verify compatibility with existing systems.

- Cost: Consider both the initial investment and ongoing maintenance costs.

- Support: Choose a vendor with excellent customer support.

- Security: Prioritize a CRM with robust security features.

- User-friendliness: Select a CRM that is easy for your team to use.

Examples of CRM Software for Financial Services

Several reputable CRM vendors offer solutions tailored to the financial services industry. These include (but are not limited to): Salesforce Financial Services Cloud, Microsoft Dynamics 365 for Finance, and specialized solutions from firms like Redtail Technology and Wealthbox. Researching these and other options is crucial to find the best fit for your institution.

Source: livetechservices.in

Frequently Asked Questions (FAQ)

- Q: What is the cost of CRM software for financial services? A: The cost varies widely depending on the vendor, features, and number of users. Expect a range from subscription-based models to more substantial upfront investments for enterprise-level solutions.

- Q: How long does it take to implement a financial services CRM? A: Implementation time depends on the complexity of the system and the size of your institution. It can range from a few weeks to several months.

- Q: What are the benefits of using a CRM in financial services? A: Benefits include improved client relationships, increased efficiency, better compliance, enhanced data security, and improved decision-making through data analysis.

- Q: Is cloud-based CRM secure for financial data? A: Reputable cloud-based CRM providers offer robust security measures, often exceeding those of on-premise solutions. However, thorough due diligence is crucial to ensure compliance with industry regulations.

- Q: Can CRM software help with regulatory compliance? A: Yes, many CRM solutions include features specifically designed to help financial institutions meet regulatory requirements, such as KYC/AML compliance.

Conclusion

Implementing a robust CRM system is a strategic investment for any financial services firm. By carefully considering your needs, researching available solutions, and choosing a vendor with a proven track record, you can leverage the power of CRM to improve client relationships, enhance efficiency, and drive growth. The right CRM can be the cornerstone of a successful and compliant financial institution.

References: Crm Software For Financial Services

While specific product links are avoided to maintain neutrality, researching reputable vendors like Salesforce, Microsoft Dynamics 365, and specialized financial CRM providers will yield relevant information. Additionally, industry publications and regulatory websites offer valuable insights into compliance requirements and best practices.

Call to Action

Ready to transform your financial institution’s client relationships and operational efficiency? Contact us today for a consultation to discuss your specific needs and explore how a tailored CRM solution can benefit your business.

Questions Often Asked

What are the key features of a good CRM for financial services?

Key features include robust security, compliance tools (e.g., for GDPR, CCPA), client portfolio management, communication tracking, reporting and analytics dashboards, and seamless integration with other financial systems.

How much does CRM software for financial services cost?

Pricing varies greatly depending on the features, number of users, and vendor. Expect a range from subscription-based models with monthly fees to more comprehensive, on-premise solutions with higher upfront costs.

What are the common challenges in implementing CRM software in financial services?

Common challenges include data migration complexities, integration with legacy systems, user adoption and training, and ensuring data security and compliance.

How can I choose the right CRM software for my financial institution?

Carefully consider your specific needs, budget, and the size of your institution. Research different vendors, compare features, and request demos before making a decision. Look for strong security features and compliance certifications.